Table Of Content

Explore our easy-to-follow home buying checklist to understand the process. Read our article to find out what questions you should ask when it comes to choosing the right lender for your needs. Walk through the home and make sure the seller hasn’t left any belongings. Check your repair areas if you requested them and keep an eye out for pests. You may also want to double-check your home’s systems one final time to make sure everything is in working order.

Buying a house? Here’s an open secret: You don’t need to put 20% down

If you can’t reach an agreement, you may want to move on and consider other properties. Read over your inspection results with your agent and ask whether they noticed any major red flags. Lenders usually don’t require a home inspection to get a loan, but you should still get an inspection before buying a property. Begin by asking family members and friends for recommendations to find a good real estate agent.

Navigate your financial life

After you know you’ve checked your credit report, the next step in the homebuying process is to determine your budget. The fastest way to get a sense of how much you can afford is with an online mortgage calculator. A mortgage calculator will estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and PMI. You can also find out how much you can afford with a home affordability calculator.

Step 2: Calculate How Much You Can Spend On A House

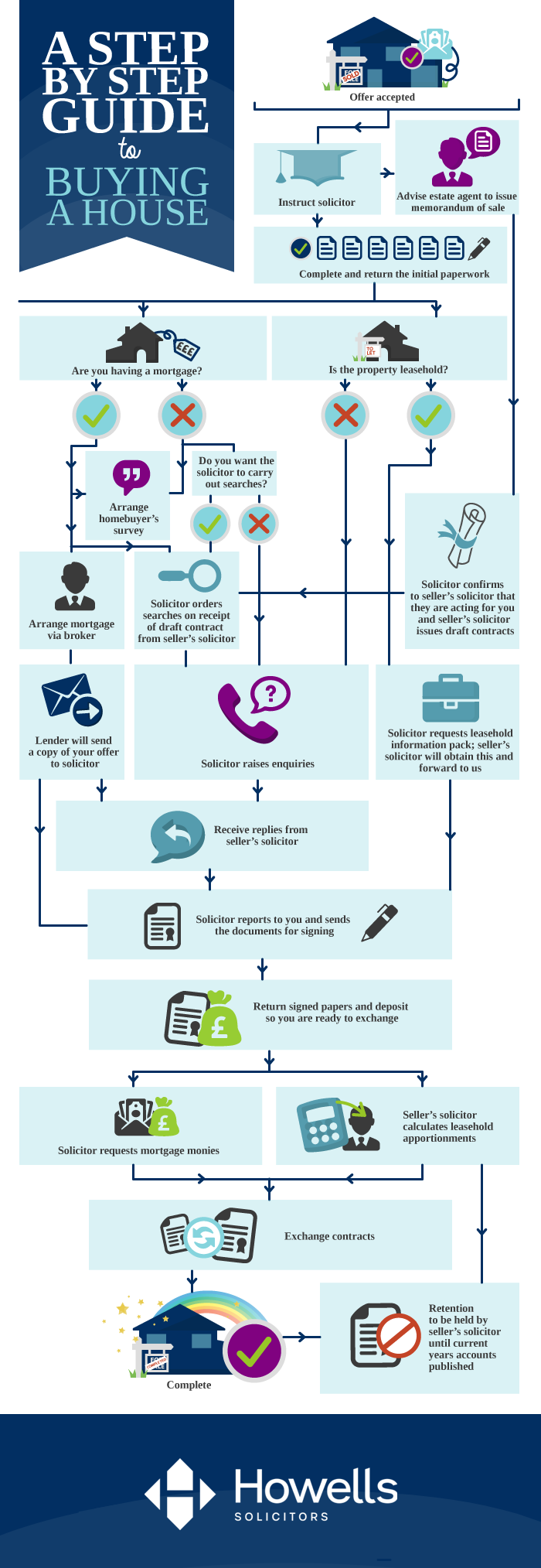

As well as the valuation your lender may have arranged for their benefit, you should also arrange an independent survey of your own to flag any potential problems. The survey itself will take a few hours and be completed by a surveyor who will then send you a report. A solicitor or licensed conveyancer will carry out the legal work, which can take between 6 to 12 weeks on average to complete. A Decision in Principle – also known as an Agreement in Principle – gives you a clear idea of how much you could borrow based on your circumstances. It usually involves a soft credit check to look at your credit history but will have no impact on your credit file.

Dealing with a financial emergency

Don't Do These 35 Things If You Want to Sell Your House - Family Handyman

Don't Do These 35 Things If You Want to Sell Your House.

Posted: Fri, 26 Apr 2024 07:00:00 GMT [source]

A home inspection is a review of the overall condition of a home. It’s a worthwhile step because it can help you catch costly issues or needed repairs before moving forward with the sale. Depending on what’s found, you may choose to request repairs, renegotiate, or cancel the purchase agreement altogether.

Once you hear back, you may have to negotiate back and forth on things like price, contingencies, and closing date until you come to an agreement with the seller. When you’re touring multiple homes, it’s easy to confuse different features or concerns so take notes as you’re touring. Buying a house is a different experience than, well, pretty much anything else. But by knowing what to expect and taking it one step at a time, you can learn how to buy a house like a pro, even if it’s your first time.

Ignore the Housing Market

Not only will this help keep you realistic about your options, but it also shows sellers that you’re a qualified and serious buyer. It’s best to shop around to find the best rate and determine which mortgage and mortgage lender are right for you. Pre-approval letters do have an expiration date, so be aware of when yours is. It’s common for home buyers to include a home inspection contingency in their purchase offer. A contingency gives buyers the option to back out of a purchase (or negotiate repairs) without losing their earnest money deposit if the home inspection reveals major issues. When you find a home you want to buy, it’s time to begin the process of making an offer.

Best Time To Buy A House In 2024 - Forbes

Best Time To Buy A House In 2024.

Posted: Thu, 18 Apr 2024 07:00:00 GMT [source]

Other Products & Services:

The views expressed in this article do not reflect the official policy or position of (or endorsement by) JPMorgan Chase & Co. or its affiliates. Views and strategies described may not be appropriate for everyone and are not intended as specific advice/recommendation for any individual. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries do not warrant its completeness or accuracy.

Home Loans For Single Parents: A Complete Guide

If you don’t have enough for a home deposit, make a savings plan. You can also create a budget to see where you can cut back and save more. In 2022, I began the process of getting approved for the CalHFA's ADU grant, which was pretty easy. But Boltansky believes ByteDance is unlikely to agree to any kind of sale. The Chinese government has said as much, arguing that it regards the algorithm as a national security asset. And without that, TikTok becomes much less appealing to potential buyers.

In fact, you will want to compare multiple lenders to determine who can give you the best rate. Start by looking at the best lenders in California, and keep in mind that some lenders specialize in certain programs. For example, borrowers looking for FHA loans will have a completely different set of needs than borrowers who need jumbo loans. In order to get preapproved for a mortgage and start house hunting, you’ll have to get your finances checked by a mortgage lender. The lender will verify that you meet basic home loan requirements and that you have the income and savings to afford a mortgage.

Before you close on your loan, your lender will give you a document called a Closing Disclosure, which specifies the closing costs you’ll be responsible for and how much you’ll need to pay. Look over your Closing Disclosure carefully to know what to expect and catch any errors. Many states offer down payment assistance programs to qualified buyers, so research whether any assistance is available to make your home purchase more affordable.

Use our guide to buying a house to educate yourself on each step and lean on licensed professionals to ensure you’re making the right decisions along the way. A home appraisal is a review that gives the current value of the property you want to buy. You will typically need an appraisal before buying a home with a mortgage loan. Before you shop for properties and compare mortgage options, you’ll need to make sure you’re ready to be a homeowner. When you review your budget, don’t overlook hidden costs, such as the home inspection, home insurance, property taxes, and homeowner's association fees. The minimum credit score to qualify for an FHA loan if you have 10% for a down payment.

Once you know what you qualify for, save time and energy by narrowing your search to homes that fit your financial criteria. Try to preview properties online, and have your real estate agent show you only listings that are right for your needs and your budget. The next move is to meet with a lender to discuss loan options and current interest rates.

A lender might be offering a great deal, but it may or may not be worth it if it comes with lower-quality customer service. Buying a house is a long and often complicated journey, so it’s essential to find a lender you can trust to make the process as simple and convenient as possible. If the survey identifies any significant work that needs doing, you may be able to revisit your offer with the seller. For example, if a house has some dampness, you may be able to factor the cost of the work into the purchase price.

Your lender helps you get the money you need, but an agent helps you find where to spend it. You don’t necessarily have to do all the work on your own, either — there are many down payment assistance programs available. Most of them are geared toward buyers who earn under a certain threshold of money each year, offering low- and moderate-income individuals a way to buy a home. For example, Redding and La Mesa are two of the cities with options to help buyers manage their upfront expenses. If you’re planning to apply for your preapproval a few months in the future, you can work on improving some of those four points. Often, the biggest difference you can make is paying down credit card balances to below 30% of their credit limits.

No comments:

Post a Comment